View Sale Announcement Detail

Archived news

Security is becoming increasingly critical in the banking industry.

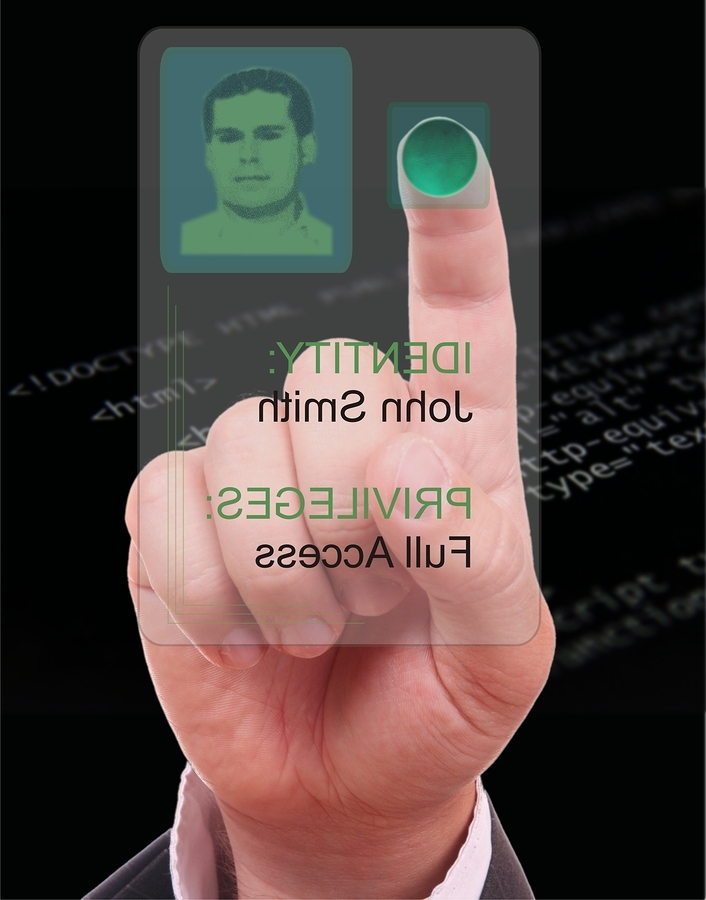

You are truly unique. From your fingerprints, to your eyes, to your online behavior, these traits are all uniquely yours, and can never be duplicated.

That's the science behind biometrics, a form of technology that's becoming increasingly popular in bank security.

We've all become accustomed to using usernames and passwords to login into our virtual bank accounts. But the future may hold something entirely different - biometrics will soon replace the need to use passwords to access our accounts in an effort to heighten security measures. As online data breaches increase in frequency, financial institutions need to look at improving security beyond easily-hacked usernames and passwords.

Soon, consumers will be able to access their accounts through ATMs and online with the use of voice activation, fingerprint verification, and even facial recognition.

Banks are continuing to adopt biometrics into their security measures, which is quickly overshadowing the standard password needed to access account information.

Biometrics is basically the measurement and analysis of a person's physical and behavioral traits. This innovative technology is predominantly used for I.D. and access control purposes, as well as for identifying people that are under surveillance. The underlying principle of biometric authentication is that each person is entirely unique, and can be identified by his or her specific physical or behavioral characteristics.

Big Banks Are Increasingly Testing Biometrics for Security Purposes

Wells Fargo has been involved in testing eye scanning and voice recognition forms of biometrics for banking security. They have been joining an increasing number of financial services firms in using biometrics technology to authenticate clients when logging on to their bank accounts via mobile applications. About one-third of the biggest banks in the US have plans of making biometrics available to mobile banking clients by 2016 year-end.

The bank's mobile development efforts include testing out speaking commands into a mobile phone. Wells Fargo is expecting to launch the new biometrics software next year, as long as they continue to plow through some technical obstacles.

Banking Security is Paying Off With Increased Consumer Trust

Banks in the US must be doing something right when it comes to security. According to a recent ABA survey conducted by Ipsos Public Affairs, 75 percent of consumers trust banks the most out of all other institutions - including alternate payment providers like Paypal - when it comes to keeping their payments safe.

Technology is continuing to drive security measures in banking institutions across the US.

Technology is continuing to drive security measures in banking institutions across the US.

Of course, banks have a long history of protecting their clients' money, regardless of whether it's online or in a vault. Surely customers are becoming even more confident in the safety and security of their funds considering the heightened technological measures banks are taking to continue to ensure that their clients' money is in good hands.

Maintaining the Budget to Cover Technology Costs For Security

It's been a tough go for banks over the past few years in terms of revenue growth. The 2008 financial crisis certainly was a rough patch, and the ripple effect afterward was no cake walk either. After the Fed dropped interest rates to historically new lows in an effort to help the US economy regain its strength, banks and credit unions have been struggling to earn a good dollar through such slim margins.

As such, banks have been making efforts to slash costs in order to keep their bottom line padded. But one area that they won't cut costs in is their technology budgets. On the contrary, they're dedicating capital to boosting security measures through more technologically driven computerized security systems for their virtual banking platforms.

In fact, the majority of banking execs are anticipating a budget hike for security technology of at least 10 percent. And that includes data analytics, mobile banking, customer-facing technology, and "big data" support.

On the opposite end of the spectrum, banks will be decreasing their expenditures on more obsolete desktops and internal investment management technology.

While the number of bank branches has been on the decline since 2009 as a result of more online and mobile avenues, the ones that are still standing are becoming increasingly equipped with advanced technology. Automatic teller machines are becoming more sophisticated, and the equipment and staff that are housed within these bank branches are being revamped in order to keep up with the digitally technological trend in the banking industry.

Keeping Up With Tight Budgets

Security is obviously a critical component in the banking industry, especially considering how digital this realm has become over the years. But many banks are feeling the burden of such financial obligations and are looking for other ways to slash costs to keep up with technology in bank security.

That's where savvy strategies in other sectors of the banking industry can come into play. Considering that loans are the bread and butter of banks, it makes sense to take steps to improve the health of loan portfolios in order to remain profitable, thereby offsetting the costs associated with beefing up technology in the security sector.

At Garnet Capital, we are well versed in the realm of loan sales and acquisitions, and can help your financial institution realize incredible success in the lending industry while having the necessary funds to implement state-of-the-art security measures.

Browse white papers at Garnet Capital to discover how our innovative team of experts can take your bank's loan portfolios to the next level.