Diversifying revenue streams and expanding product sets can effectively help banks to boost profitable loan portfolios.

Diversifying revenue streams and expanding product sets can effectively help banks to boost profitable loan portfolios.

After the financial meltdown in 2008, it seemed like diversification simply didn't work.

With just about every asset class crashing during that time period, many financial institutions weren't too keen on the idea of diversifying to hedge against risk simply by spreading out among various types of products.

Now, perceptions are starting to shift.

With today's banking clients being much more diverse, it only makes sense for bankers to change in order to follow suit.

Financial institutions will be better able to compete if they're able to offer a wider range of products.

Diversifying Loan Portfolios While Maintaining Compliance to Regulations

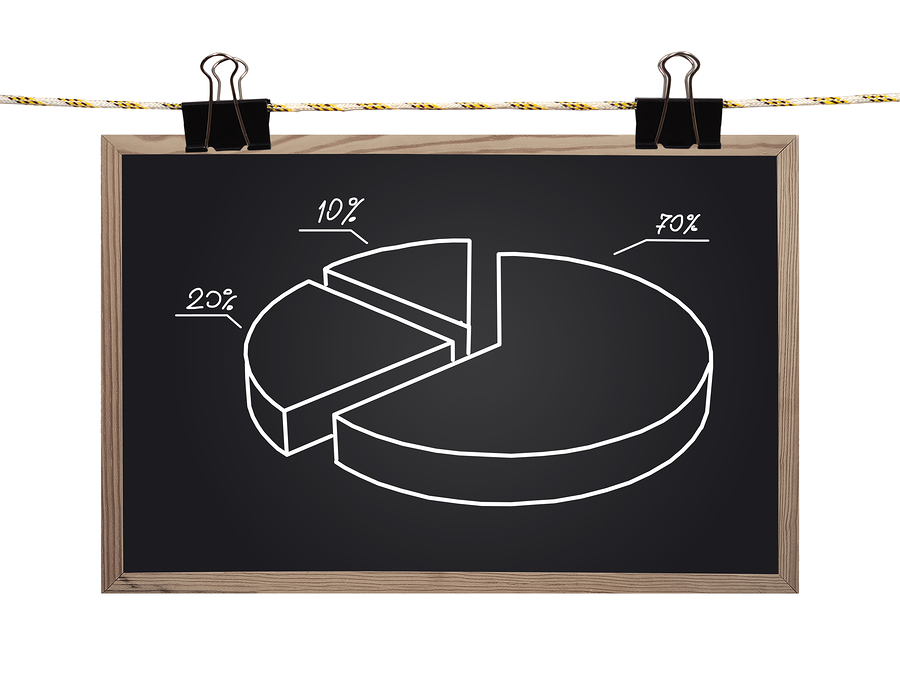

Many banks, be they community banks or larger-scale firms, are often challenged with the dilemma of how much to concentrate on certain assets while attempting to diversify. With regulators keeping a close eye on banks who may be placing too much focus on certain loan assets that may place them at concentration or other type of risk, it can be stressful to avoid making too much capital vulnerable in an overly-broad portfolio.

It's important to consider how to comply with regulations while improving the quality and resilience of your bank's loan portfolio.

The main advantage of diversifying loan portfolios is to

make them more predictable and pliant. It's the old "don't put all your eggs in one basket" type of scenario. Banks need to ensure that their loan assets aren't too concentrated by industry, geography, or client.

The Baskets Need to Be Distinguished From Each Other

In order to achieve such resilient diversity, developing a loan portfolio with loan asset classes that

aren't necessarily highly correlated is key. There's no real reduction of risk if every bucket included in a diversified portfolio is performing just as poorly as the next.

While incorporating additional loan categories can be an effective means to diversify a loan portfolio with minimized risk, it isn't necessarily the only way. Banks can effectively classify existing loan classes by the quality of the loan. For instance, one category may be limited to a certain percentage of loans that are deemed top-tier credit ratings.

Of course, this is just one of many metrics that can be applied, and each banking firm can develop its own unique policy to define its loan classes.

Pleasing Existing Clients and Attracting New Ones

Whether banks decide to expand their consumer lending products or their small-business loan options, there are opportunities for banks to vary their loan portfolios. The benefit to such diversification is higher revenues, as well as a hedge against unnecessary risk. Banks can boost earnings from existing clients by offering more services and enhancing customer loyalty. In turn, clients will likely be more satisfied with the fact that they can use the bank for many types of products and services.

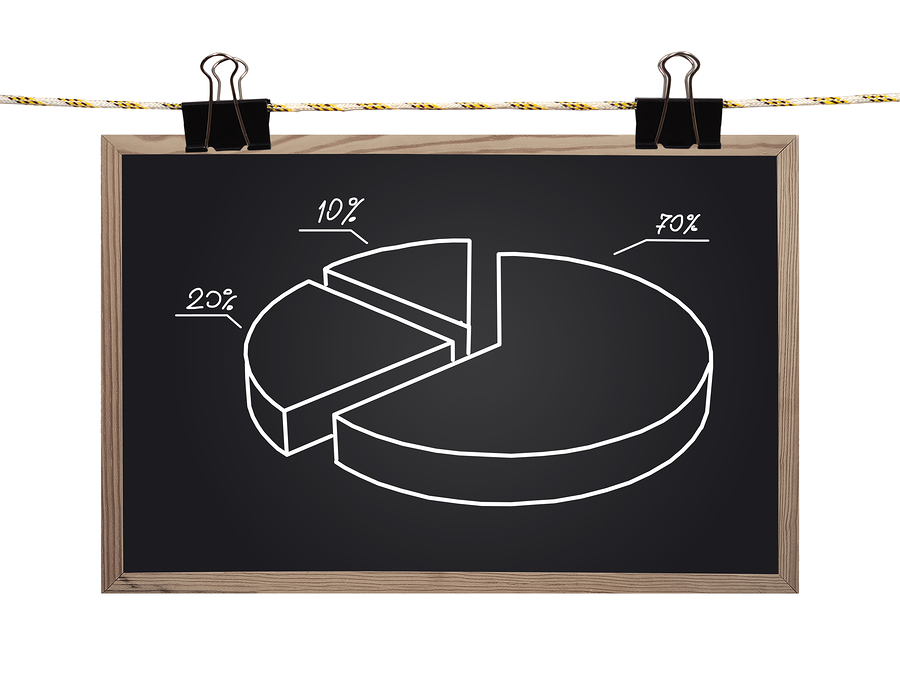

Banks can certainly benefit by diversifying their loan portfolios, as Bank of America has done.

Banks can certainly benefit by diversifying their loan portfolios, as Bank of America has done.

In addition to pleasing their current client base, banks that embrace diversification can also attract new clients. The interest in more convenient and easily-accessed loans among Millennials, for instance, might be enough to convince this growing demographic to work with a specific bank because it offers this particular product to its customers.

Big Banks on the Diversification Train

Plenty of banks are already setting their sights on expanding their reach, if they haven't done so already.

JPMorgan Chase, for one, is planning on growing its revenues by adding asset and loan partners in new geographical locations in trading and investment banking. The bank is diversifying revenue channels in asset management, and growing its product range.

Bank of America is also extensively diversified, both in terms of geography and industries. Consider the current low energy prices - even if BofA has to write off millions of dollars in energy loans throughout the next few quarters, only a fraction of that will affect its income statement thanks to its accumulated reserves and diversification among other sectors and assets.

The bank's

energy loans account for only two percent of its entire loan portfolio. Further, higher-risk sub-segments of the oil sector only account for

39 percent of Bank of America's energy portfolio.

Diversification doesn't necessarily mean that risk is off the table; it simply means that such risk is likely to be significantly reduced.

Diversification definitely carries its advantages - it can significantly limit banks' exposure to economic shocks and keep bank earnings even-keeled.

Diversifying can certainly help to

strengthen a loan portfolio and reduce its risk. But placing focus on the strength and concentration of each segment of a loan portfolio is also important. Doing so can allow financial institutions to gain better insight and understanding of the intrinsic risks that exist within their portfolios.

Before adding new loan classifications, banking firms must make sure that adequate resources are available to take care of servicing and underwriting. As much as diversifying can be the ideal avenue to take in our modern banking world, it also comes with its own set of potential risks.

For this reason, it's imperative to partner with experts in the field of loan portfolio diversification to ensure risk management is at its peak.

And that's precisely what Garnet Capital is here for.

Sign up for our newsletter today to discover why your bank needs a loan portfolio expert team like Garnet Capital to help effectively diversify to increased profits and reduce risk.